Democracy and despotism in a digital age.

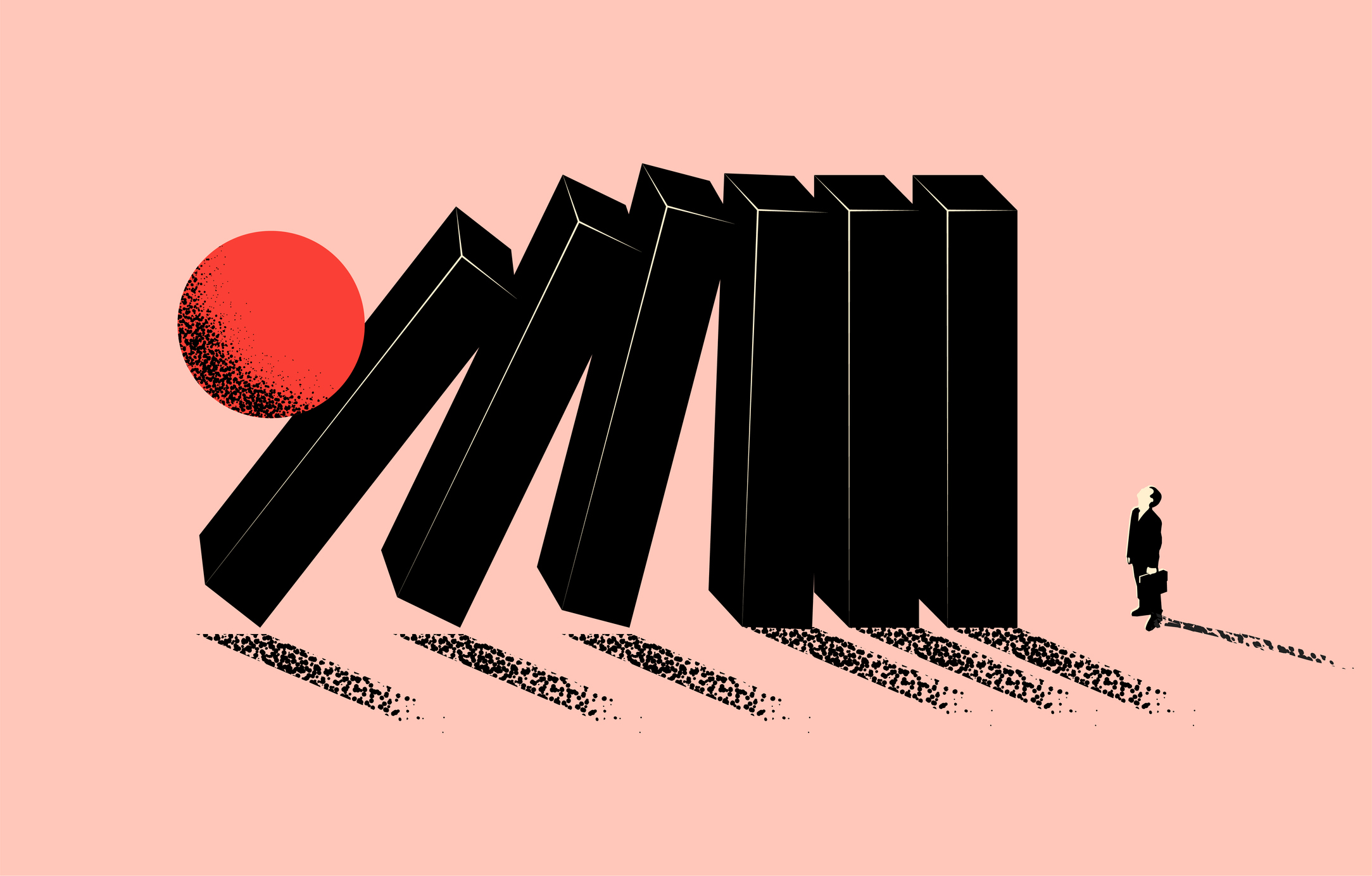

Our Problem Is Fragility

American institutions are unwinding.

American institutions are increasingly fragile, in the sense that smaller shocks to the system are capable of doing large amounts of damage. This fragility is, unfortunately, the result of deliberate policy actions on the part of our ruling elite. From the international monetary system to the U.S. financial system to our national security decisions, the choices of our ruling elite are opening the door to catastrophic collapse. Such collapse is not inevitable, but conditions are such that our institutions are susceptible to catastrophe.

The International Monetary System

The emergence of the modern international monetary system is shrouded in mystery, even among economists. If you ask otherwise-knowledgeable people why the dollar-based system exists you will be given answers like path dependence, or a lack of a good alternative, or a discussion of the problems of the gold standard. What these arguments ignore is the role that politics, statecraft, and national security play in decisions about the monetary regime.

During the Napoleonic Wars, Britain accidentally discovered a powerful tool when it suspended the convertibility of Bank of England notes into gold, with the promise to restore convertibility at the previous parity after the war. This allowed the Bank of England to expand its balance sheet dramatically to help finance the war. At the same time, the commitment to restore the previous parity with gold represented a commitment to follow any resulting inflation during the war with deflation at its conclusion. By anchoring expectations, the British were able to use the Bank of England as an effective tool for financing wartime expenditures without the risk of outcomes such as hyperinflation, normally associated with significant money-printing. Countries that failed to replicate this sort of policy, like Sweden and its Riksbank, failed to maintain their empires.

By World War I, this lesson seemed to be broadly understood. Combatants in the First World War, pressed to increase spending, suspended the convertibility of their currencies into gold. America’s delayed involvement in the war meant that the U.S. remained on the gold standard and was the beneficiary of gold inflows for much of the war. Following the war, the distribution of gold was concentrated in the U.S. Attempts to restore the pre-war parity with gold throughout the rest of the world required a change in the distribution of gold that could only come about through international cooperation. Although some degree of cooperation occurred early on, the United States and France ultimately prioritized their own domestic policy objectives. This created a global scramble for gold, the result of which was massive global deflation and economic depression.

Following World War II, the Allies were keen to avoid the disastrous consequences of the interwar period and set out to design a new international system, which resulted in the Bretton Woods Agreement. This system sought to make the dollar and gold perfect substitutes as global reserve assets. Since the U.S. could control the supply of dollars, a shortage of gold could not have the catastrophic consequences it did during the interwar period since the dollar could be substituted for gold. However, the substitutability of the dollar and gold was hard to guarantee, and was impacted by U.S. policy. Expansionary monetary and fiscal policy in the sixties led to outflows of dollars much larger than foreign governments and central banks wanted to hold. Initially, the U.S. tried to get foreign central banks to take U.S. Treasury securities rather than gold. This worked in fits and starts throughout the 1960s. But when foreign redemptions of dollars drained gold reserves, maintaining the Bretton Woods system would have required the U.S. to restrain its foreign policy objectives and impose fiscal discipline at home. Instead, Nixon closed the gold window.

The Nixon shock and the U.S. abandonment of the Bretton Woods system was seen in those early years as a sign of U.S. weakness and decline, but the Nixon, Ford, and Carter administrations all took steps to maintain the dollar’s status as the global reserve currency. U.S. policymakers used triangulation with Europe and Japan to prevent coordination against U.S. plans. Following the oil shocks of the early 1970s, the U.S. made secret agreements with Saudi Arabia in which the Saudis would continue to price oil in terms of dollars and invest their growing dollar balances in U.S. Treasury securities in exchange for military security guarantees.

By the early 1980s, what had emerged was the current international monetary system in which U.S. Treasury securities serve as the global reserve asset. Like Britain of an earlier era, the system created by the U.S. created the ability for unprecedented borrowing. As a result, the U.S. now had the flexibility to borrow dramatically during wartime and other national emergencies. The Volcker disinflation and the subsequent period of low inflation gave holders of U.S. Treasury securities the confidence to hold these assets long-term.

Nonetheless, this system is not without costs. As other countries grow wealthier, their demand for the reserve asset grows proportionately, which tends to push down interest rates in the U.S. and signal that the U.S. has greater borrowing capacity. The incentive to borrow on cheap credit leads to a world in which the supply of U.S. Treasury securities grows in proportion to the growth in demand, thereby growing the U.S. debt burden.

While some acknowledge this reality, they deny that it matters. Yes, they say, the U.S. government is going more and more into debt, but as long as people want to hold that debt it is not a problem. Others say that the U.S. is in no danger of a debt default because its debt is denominated in a currency for which it controls the supply. Can’t pay the debt? Just print the money. But debt payments carried out via inflation is just another form of default. Holders of U.S. Treasury securities who find that their debt gets repaid, but that their dollars provide them less purchasing power than they started with are unlikely to continue to hold these securities.

Herein lies the inherent fragility baked into the system. What is critical to the system continuing is a continued expectation that the U.S. will not resort to inflationary finance. But the U.S. does not actually have to resort to inflationary finance for the system to unwind; just the expectation that the U.S. will resort to inflationary finance will trigger inflationary finance as a self-fulfilling prophecy. In other words, the biggest threat to the system is that others might suddenly expect that the U.S. has an unsustainable level of debt. U.S. policymakers could mitigate this risk by limiting the national debt, but the system itself incentivizes the U.S. to take on higher and higher debt levels. Hence, the fragility.

There is another source of fragility related to productive capacity. The fact that the U.S. Treasury security is the global reserve asset of the world means that the United States has to be an exporter of dollars. If the U.S. fails to export enough dollars, the dollar appreciates on world markets. The appreciation of the dollar leads American consumers to use their increased purchasing power to buy more imports and for multinational firms to shift production overseas.

As a result, the manufacturing base of the United States has been hollowed out. Ardent free traders argue that this doesn’t matter and this merely reflects differences in comparative advantage. Such arguments ignore the realities of international finance. In addition, the narrowly rationalistic adherence to free trade ignores the role of manufacturing production capacity during wars and other national emergencies critical to a state’s success and survival. During times of war and other emergencies, like the recent pandemic, manufacturing capacity is typically shifted to other uses like building ships, tanks, weapons, ventilators, etc. A country that lacks manufacturing capacity will find itself ill-equipped to the task. This is yet another source of fragility caused by this system.

Our Domestic Financial System

Similar fragility has developed in the domestic financial system. Following the 1987 stock market crash, Federal Reserve Chair Alan Greenspan’s use of expansionary policy created a clear signal to markets that Federal Reserve policy itself puts a floor under asset prices. In other words, the Fed will always be willing to backstop losses.

This view has only been reinforced by subsequent action. The Federal Reserve’s active role in the aftermath of the collapse of Long-Term Capital Management and its response to the Great Financial Crisis have only reinforced this belief. During the financial crisis, the Federal Reserve moved beyond monetary policy (buying and selling assets in the open market to manage liquidity) to credit policy, whereby they created multiple credit facilities to more directly target its efforts at particular financial firms. This process was expanded during the pandemic.

Advocates of these policies argue that these actions are designed to prevent significant economic costs and financial catastrophe. But a byproduct of these policies is that they incentivize greater risk-taking. The Federal Reserve—and policymakers more generally—have created a “heads I win, tails taxpayers lose”-type payoff structure for big players in the markets. Large financial institutions are incentivized to take on more risk, because they have the expectation that the Federal Reserve will bail them out, or Congress will authorize the spending necessary to do so. Financial firms are also incentivized to take on greater amounts of leverage to maximize the expected returns of their shareholders.

As financial institutions assume more leverage and greater risk, they introduce fragility into the system. Greater risk makes it more likely that the bet does not pay off. Higher leverage makes the firm less likely to withstand a given shock.

The policy response to this phenomenon has been heavier regulation of banks deemed too-big-to-fail. This has the perverse effect that whenever there are signs of instability in the banking system, customers flee to the too-big-to-fail banks, further increasing concentration in the banking system.

Our Foreign Policy

The United States is lost in the wilderness regarding national security. Wars should be fought for the purpose of bringing about peace, and fought only when they are in the national interest. Wars are won when the objective of victory is clearly defined and the means to achieve that victory are attained.

Since at least the end of the Cold War, however, these well-understood principles have been cast aside. The United States goes to war not only without a declaration of war from Congress, but often without even a clear definition of what the war is about. Victory is never defined, partially because wars are undertaken to advance abstractions. Wars to end terrorism and extremism or to promote democratic governance do not come with clear objectives for victory. Unsurprisingly, these wars are prolonged and largely end as a result of fatigue or a pivot to some other conflict.

Part of the reason for the nation’s erratic military adventuring is that the international monetary system has created a new tool for foreign policy. The critical role of the dollar as the global reserve currency gives the United States a unique tool. Foreign adversaries are targeted by preventing them from using the dollar-based financial system for payments and having their dollar-denominated assets frozen by the U.S. Treasury Department. These policies are meant not only to punish known adversaries, whether they be individuals, terrorists, or foreign central banks, but also to deter would-be adversaries of the consequences they face. But overuse of this tool can also contribute to the fragility of the dollar-based financial system as adversaries, and potential adversaries, look to use or create alternatives. Thus far, there is some evidence of withdrawal from the dollar-based system, as some foreign adversaries have reduced the share of their reserves devoted to U.S. Treasury securities, purchased gold, and moved their reserve assets within their own legal jurisdictions and away from the U.S. This is yet another contributor to the fragility of the system.

Our Institutions

Perhaps it would make it easier to sleep at night if there was evidence of an intellectual and professional class capable of dealing with the consequences of fragility. Unfortunately, there is no evidence for that. The public schools and the universities have been largely taken over by ideology and the need for rectification of social injustice. The students produced by this system and indoctrinated in this ideology now form the ruling class. They are overwhelmingly represented in government bureaucracies and the media.

The consequences are straightforward. The last two decades in the United States have been marked by one institutional failure after another, most notably when the financial crisis revealed the failures of government bureaucracies tasked with regulating the financial sector and when the pandemic revealed the public health bureaucracy as devoid of leadership, knowledge, or general competence. These failures are caused by the fact that U.S. institutions no longer select for competence, capability, or intelligence. The ideology has so permeated society that it is now a central characteristic of the ruling class. One’s position in the regime and broader society is dictated by adherence to the regime’s ideology. Institutions select for those who can utter the correct shibboleths.

The implications are important. Catastrophe can occur even without inherent fragility in the system. Unknown unknowns cannot be anticipated, by definition. Regardless of the source of catastrophe, capable and competent leadership can potentially bring a state through the difficulties and even make it stronger on the other side. There is no sign that this is even a possibility at present. Time and again, these institutions demonstrate that they are populated by those unprepared, unqualified, or otherwise incapable of dealing with catastrophe.

Our Fragility

We have now arrived at a moment in which the international monetary system is intensely fragile and the domestic financial system has encouraged risk-taking while minimizing any consequences to large financial players whose big bets do not pay off. U.S. foreign policy is incoherent and over-extended. The public schools, universities, and bureaucracies captured by ideas that are detached from empirical evidence or historical experience. Each of these outcomes by itself is enough to cause concern that some small shock to the system could have the potential for catastrophic outcomes and yet we are faced with the combination of multiple sources of fragility.

Any attempt at American renewal needs to be aimed at reducing the fragility that has been introduced into the system. The task is daunting. It requires re-thinking the international monetary system, reintroducing market incentives into domestic financial markets and banking, holding our national security apparatus to account, overhauling our public schools, radical reform to our universities, and dismantling the bureaucracies operated by credentialed mediocrities who see themselves as part of an enlightened ruling class. The work will be difficult, and no one is coming to save you. But at least the problem has been identified.

The American Mind presents a range of perspectives. Views are writers’ own and do not necessarily represent those of The Claremont Institute.

The American Mind is a publication of the Claremont Institute, a non-profit 501(c)(3) organization, dedicated to restoring the principles of the American Founding to their rightful, preeminent authority in our national life. Interested in supporting our work? Gifts to the Claremont Institute are tax-deductible.