Democracy and despotism in a digital age.

“Economic Justice” Isn’t Just

Debunking a contradiction in terms.

Economic inequality dominates the news. More and more Americans say too much wealth is in the hands of too few—an undesirable, if not unjust, economic state of affairs. The answer, according to some, is higher taxes.

The concerns about economic inequality are many: limited opportunities that leave the less fortunate behind; potential resentment and social unrest; excessive political power among the rich; the unfairness of huge financial gains among a tiny class of successful entrepreneurs and investors, those seemingly fortunate to benefit from, perhaps, good genes, a privileged upbringing, elite education, unique career options, even blind luck.

In light of these concerns, advocates for higher taxes are speaking out. A group of affluent liberal businesspeople recently wrote an open letter calling for a wealth tax on the richest of the rich. A prominent Los Angeles philanthropist published an op-ed supporting a wealth tax. A progressive think tank issued a lengthy report advocating “a better way of incorporating wealth and the income it generates into the determination of how much tax a person owes.” Many of the current Democratic presidential hopefuls are now calling for higher taxes on the wealthy.

Clearly, nearly everyone recognizes the need for various government programs and services, including social welfare programs to help those in need. And, while opinions on the appropriate level of tax rates differ across the political spectrum, everyone acknowledges the need to pay taxes to cover the costs of such programs—with those making the most paying a disproportionately large share of the taxes.

But the issue of economic inequality is entirely different. It arises from a consequentialist complaint: that what’s fair and just is defined by some societal result—a particular economic state of affairs. Accordingly, justice entails adjusting economic outcomes so that there’s not too much economic inequality.

On its face, this may sound reasonable. Many are inclined to make judgments that the current state of affairs is not only not ideal but it’s also unfair and unjust. If we could just impose a tax on the very wealthy, some believe, then we could even things out and have a fair and just state of affairs—true economic justice.

Conservatives have long argued against such egalitarian policies, claiming they’re inconsistent with traditional conservatism or other conservative ideas—classical liberalism, limited government, constitutionalism, natural law, economic liberty, free markets or “spontaneous order.” Conservatives insist these political and economic ideas redound to more freedom and prosperity for more people over time.

While compelling for conservatives, ideas about limited government and free markets typically center on relative political or economic gains. As such, they only indirectly address the call for economic justice, which is, at root, a moral claim. If something’s unjust, it needs to be judged and remedied, period.

What is Justice?

Despite thousands of years of effort, there is still no agreed-upon theory of justice. As University of Arizona philosophy professor David Schmidtz explains in Elements of Justice (2006), we do agree that “justice concerns what people are due. Exactly what people are due, though, cannot be settled entirely by conceptual analysis.” Different political partisans appeal to different theories of justice.

One popular conception of justice is distributive. Under this theory, the distribution of goods throughout society should be determined by some designated rule. However, even for those disposed to support this idea, there’s no agreement on the rule. Do we distribute so that everyone has enough primary goods to live a decent life? Enough basic human capabilities to live a dignified life? Enough to keep economic inequality to a minimum? Moreover, not only is there no agreement on the rule, there’s also no agreement on how to define the measure of the rule—what it takes to live a decent life, or to become fully capable of living a dignified life. The “fair” amount of economic inequality remains deeply contested.

Another notion is the utilitarian theory of justice, which is based on the greatest good for the greatest number, or, in economic terms, the maximization of everyone’s utility. But how do we define the good for everyone? How do we calculate the maximization of everyone’s utility? How do we compare what’s of utility for one person to that for others? And what about the rights of those in the minority?

The traditional—inherently Biblical—theory of justice affirms that the best approach is holding individuals accountable for their actions. This is a decidedly non-consequentialist approach. Did someone steal another’s private property? Did someone intentionally hurt someone else? These are acts that individuals, under their own volition, can potentially commit and for which they can be held accountable. In adjudicating what’s just, there is to be equality under the law—with no favoritism towards the rich, nor the poor. Justice is to be blind.

In contrast to this traditional notion of justice, economic justice is not focused on individual acts for which one can be held accountable. It’s focused on states of affairs, like levels of economic inequality. But can states of affairs be judged as just or unjust? Or are they sometimes simply desirable or undesirable? Heartening or regrettable? One may prefer that society look a certain way, with some acceptable level of economic inequality, but is this a matter of justice?

Referencing social justice, Thomas Patrick Burke addresses this issue in The Concept of Justice: Is Social Justice Just? (2011). “[S]ince social injustice is not primarily a quality of will, but of external states of affairs in society, namely inequality, there may be no one to punish…inequality can arise entirely by accident without anyone intending it or being responsible for it. It is not an action, or a product of an action.” States of affairs do not imply that any one individual has done anything unjust. In and of themselves, they are not moral or immoral, just or unjust. They just are.

Theft in the Guise of Kindness

Dissatisfied with this conclusion, some seek to define a theory of justice that applies to states of affairs. How exactly would the government remedy supposedly unjust economic disparity? It’s one thing to collect tax revenue to help cover the cost of public services and programs. It’s another to assess, tax, and redistribute wealth to reduce economic inequality. Even with a coherent moral theory to back up the policy, the government has no effective and feasible means to “spread the wealth around” in this way.

No wonder the call to reduce economic inequality falls back on moral judgments. The claim, however, conflicts with the traditional notion of justice. Taxes on wealth to reduce economic inequality would be what Frédéric Bastiat called “legal plunder.” To discern legal plunder in action, Bastiat writes in The Law (1850), “see if the law takes from some persons what belongs to them, and gives it to other persons to whom it does not belong. See if the law benefits one citizen at the expense of another by doing what the citizen himself cannot do without committing a crime.”

Under the theory of economic justice, taking more of the wealth away from the rich to give to others is viewed as being the just thing to do—to reduce the level of economic inequality. But under the traditional notion of justice, the government taking money from the wealthy and redistributing it to others is legal plunder. The theories are irreconcilable.

We have a predicament. We must make a choice between them. Which one should take precedence? Which is authoritative? Claremont McKenna College philosophy professor Paul Hurley, in Beyond Consequentialism (2009), sums up the issue. “Consequentialist moral theories are not theories of the relationship between reasons to act and right action,” he notes. “They are instead theories of the relationship between right actions and good overall states of affairs, upon which an action is morally right just in case its performance leads to the best state of affairs.”

If agents have decisive reasons to do what they are morally required to do, and to avoid actions that are morally prohibited…but they often have sufficient reasons not to bring about the best state of affairs…then agents cannot be morally required to bring about the best overall state of affairs and morally prohibited from any other course of action. But consequentialism…holds that this is precisely what morality does require of agents.

Not only are we required by consequentialism “to be moral saints,” Hurley concludes; “it presupposes that we are rationally required to be moral sinners even as it morally requires us to be moral saints.” In a similar vein, Harvard professor Eric Nelson holds that “moral egalitarianism (the idea that all individuals ought to be able to identify and pursue their own idea of the good life without coercion) and economic egalitarianism (the idea that coercion should be used to ensure a more equal distribution of wealth) cannot easily coexist in the same theory.”

The consequentialist position is untenable. It entails actions that, when done for the purposes of changing an economic state of affairs, are viewed as the fair and just thing to do, but, when viewed on their own, from the perspective of an individual, are unjust. There is no way to escape this conflict. Consequentialism demands that traditional justice be subordinated to some economic goal.

An Idea as Un-American as it is Unjust

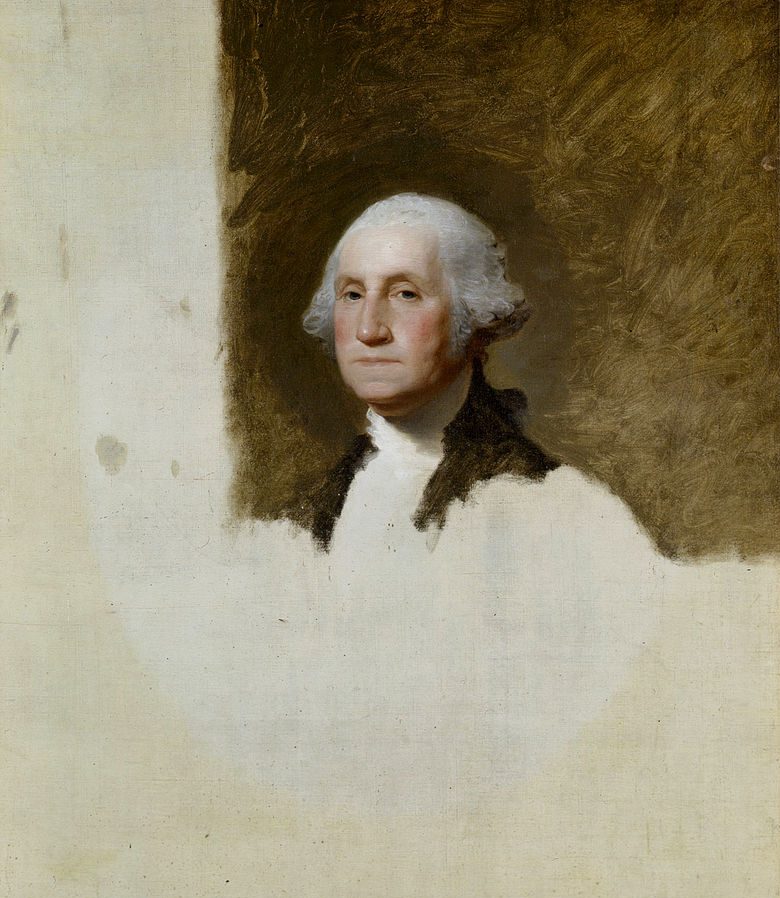

The use of economics to justify a consequentialist theory of justice has no basis within the American tradition. The concept of economic justice did not exist at the time of the Founding, nor was there any movement calling for a certain level of economic equality or some other preferred economic state of affairs. The Founders did not introduce the idea because they understood that justice is a political question. They focused on getting government right, and, for them, securing justice was the purpose of government.

This meant, first, finding ways to limit the potential reach and abuse of government power. As James Madison explained in Federalist 51, “in framing a government which is to be administered by men over men, the great difficulty lies in this: you must first enable the government to control the governed; and in the next place oblige it to control itself.”

Government is to be limited to its just purposes, namely, securing justice. “Justice,” Madison wrote in Federalist 51, “is the end of government. It is the end of civil society. It ever has been and ever will be pursued until it be obtained, or until liberty be lost in the pursuit.”

Madison recognized that everyone is different with different faculties. But this did not mean that government should aim to equalize outcomes in order to adjust for such differences. “The protection of these faculties is the first object of government,” Madison observed in Federalist 10. “From the protection of different and unequal faculties of acquiring property, the possession of different degrees and kinds of property immediately results.” Government is to protect liberty and to protect property—in their inevitably diverse and unequal portions.

Madison also recognized that factions could and would arise from the “unequal distribution of property.” But the aim was not to limit factions nor to limit economic inequality. Rather, first and foremost was a concern about the tyranny of the majority—i.e., a concern about potential threats to liberty. Accordingly, the Fifth Amendment states that no one shall be “deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

With many disregarding the traditional understanding of justice, the politics of economic inequality will probably not go away. The consequentialist call for punitive taxes on “the wealthy” will likely continue, and, to some, it may sound just. But economic justice will remain at odds with America’s Founding, not feasible in practice, and, most importantly, not just.

The American Mind presents a range of perspectives. Views are writers’ own and do not necessarily represent those of The Claremont Institute.

The American Mind is a publication of the Claremont Institute, a non-profit 501(c)(3) organization, dedicated to restoring the principles of the American Founding to their rightful, preeminent authority in our national life. Interested in supporting our work? Gifts to the Claremont Institute are tax-deductible.

Libertarianism again fails natural right.

Revisionist Black supremacist history can't grasp our shared equality.

In a collapsing age, humor and spirit alone won’t do us justice.

It’s time to bet on humanity—before things get worse.