Decentralized protocols are the way out.

Après Le Déluge, Bitcoin

It’s time to depoliticize our financial infrastructure.

The latest hobby du jour for bored Covid-19 internees involves speculating about the lingering effects of the virus on society long after the miasma has passed. Few of these effects will be new, strictly speaking: the virus is perhaps best described as an accelerant for trends already underway. Commonly mentioned examples include an increase in remote work and distributed teams, the rise of e-sports, a resurgence of political localism, and the re-onshoring of supply chains. Less frequently mentioned is the potential impact on our financial system.

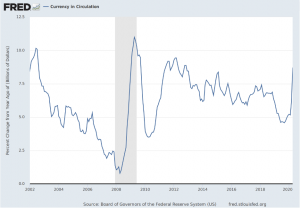

In the short term, the Fed’s rapid response to the pandemic appears to have alleviated chaos in the repo markets, as well as illiquidity issues in fixed income which saw massive bond ETFs trading at huge discounts to NAV. Elsewhere, we’ve seen savers spooked by banks withdrawing physical cash at elevated rates.

But even more interestingly, the combination of forced lockdown and extreme market volatility has exposed cracks in our financial infrastructure.

Stimulus plans have been hampered by America’s creaking banking system. Several states have made desperate entreaties to a dwindling supply of COBOL developers as they struggle to process unemployment claims on 40-year-old mainframe infrastructure. Lacking a direct method to get cash in the hands of individuals, the U.S. government has opted for a combination of direct deposit (eligibility requires having filed a tax return in the last year) and mailing physical checks to the remainder.

Unsurprisingly, fintech companies like Square, which can plausibly claim to be a force for financial inclusion, have offered to fill in. But one wonders how that will comport with their policy of arbitrarily deplatforming individuals with whom they disagree politically. “Just private companies,” the refrain goes. Except when carrying out government business, that is…

Do Central Bankers Dream of Electronic Dollars?

To alleviate these pressures as we enter a regime of permanent “stimulus” and direct handouts to individuals, some members of Congress have begun to contemplate a system in which regular savers are granted accounts with the Federal Reserve so the government can frictionlessly remit them new digital dollars as needed. This is sometimes referred to as a Central Bank Digital Currency (CBDC)—a curious phrase, considering that the vast majority of dollars are already digital.

These discussions have undeniably been catalyzed by China’s declared intention to pursue a CBDC. However, a CBDC of this nature will carry embedded assumptions about privacy and control which are largely incompatible with American values. The question for us is: ought the Federal Reserve to establish a retail banking relationship with the American public?

Policymakers favoring the idea put forth visions of a hyper-efficient system for payments, as well as the financial infrastructure fit to support a future UBI initiative should one be needed. They are also enticed (although this is said more quietly) by the promise of super-granular control over the money supply, a privilege currently impaired by the existence of cash. The zero lower bound on interest rates does not exist when you have the nation’s bank account balances under your direct purview.

We can expect that commercial banks will resist this. It’s unlikely that a system which would effectively nationalize banking would pass the K Street gauntlet. And for the general public, a CBDC conjures up images of a dismal DMV-for-banking experience.

So if not the government, nor the established banks, where will innovation in financial infrastructure come from? The obvious candidates are public blockchains—neutral financial infrastructure—already deployed at scale globally.

I think it’s likely that the crypto-financial system will take a huge bite out of the legacy financial system, not because public blockchains are inherently better from a technological standpoint, but because they are simply not subject to the same encumbrances as the sclerotic, highly-regulated financial industry. They expose the provision of financial services to a genuine capitalist impulse.

In fact, you could plausibly argue that public blockchains, by virtue of their inherent scalability constraints, are at a massive disadvantage relative to permissioned systems which scale far more efficiently by default. So why are they so popular? And why is a global class of young entrepreneurs defecting from finance and choosing to work on crypto instead?

One way to look at it is to understand the appeal of Bitcoin and the cryptocurrency industry more broadly as a reaction to the clear degeneration of the current financial system. Of course there is a monetary component to Bitcoin’s specific allure: imposing a rigid monetary policy, and creating a free market for the issuance of new units, such that no government can perform seigniorage. This gets the headlines. However, catalyzed by and building on Bitcoin’s success is a broader phenomenon: the buildout of politically neutral payments and settlement infrastructure.

A Politicized Financial System

It’s an unfortunate reality that the current, U.S.-administered financial system has become entirely politicized from top to bottom. At the retail level, a tight oligarchy of payment processors routinely unpersons and deplatforms individuals and businesses who they believe have committed wrongthink. Forget due process. These are private companies. At the local level, bloated police forces finance themselves through petty banditry by arbitrarily seizing cash in transit. This is euphemized as civil asset forfeiture. At the federal level, Obama’s Deptartment of Justice made a habit of harassing commercial sectors deemed unsavory by pressuring banks to deplatform them. The aptly named Operation Choke Point saw numerous gun manufacturers and other businesses considered ‘high-risk’ unbanked with no due process or evidence of a crime committed.

One general trend unites these case studies: the gradual creep of the Bank Secrecy Act has effectively outlawed anonymous transactions, as most commerce has become digitized. By superimposing political objectives on finance, bureaucrats and bankers can commercially hamstring organizations and individuals of their choice, efficiently and at scale.

And most transparently, the U.S. takes full advantage of New York’s centrality within the correspondent banking system, as well as its influence over SWIFT to fight bloodless wars through sanctions. Most notably, the U.S. recently exerted sufficient pressure on the Belgium-incorporated SWIFT cooperative to cut off the entirety of Iran’s banking system from the rest of the world. Abuse of their privilege as the world’s financial coordinator has led European allies to seek alternatives and end-arounds, while China and Russia diligently work on their own messaging services.

Apolitical Alternatives

By contrast, public blockchain infrastructure like Bitcoin or Ethereum, and the tools built on top of them, are or at least strive to be apolitical. The creators of these systems bind themselves to the mast, resisting the siren song of monetary discretion. Satoshi Nakamoto, Bitcoin’s pseudonymous creator, has not had any influence over Bitcoin’s development since 2011. The current set of influential Bitcoin developers follow an excruciatingly slow, consultative process which more closely resembles the development of an open source project like Linux.

Ultimately, a combination of the miners and the operators of economic nodes—the actual users of the system—must ratify major changes by adopting new software. Since consensus formation among these diverse stakeholder groups is extremely difficult, Bitcoin’s protocol itself hasn’t undergone a meaningful new change since summer 2017. In the long term, Bitcoiners look forward to full “ossification,” in which new changes occur at a glacial pace or halt altogether. You cannot exercise political discretion if the system is extremely resistant to change and power is distributed across millions of individual computers.

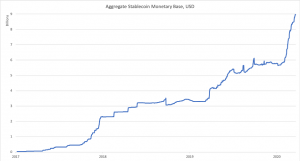

And interestingly, these systems do not just settle their own “native” currencies. They carry dollars, too. Crypto-skeptics might be surprised to learn that as of today, billions of dollars worth of tokenized fiat settle on public blockchains every day. This unites the high-quality settlement assurances of blockchains with the low-volatility characteristics of fiat, tackling the most common objections to cryptocurrency. Indeed, the monetary base of these crypto-wrapped dollars has recently surpassed $8 billion.

Source: Coin Metrics

Dozens of deployed stablecoin projects exist today, with six of them boasting over $100m in assets circulating “on chain.” Employing various collateral types and issuing IOUs to a global audience which settle on permissionless crypto rails, these recall high-powered banknotes from the free banking systems of yore. The implications of this phenomenon have just begun to be contemplated.

Fundamentally, crypto-financial rails distinguish themselves from their legacy counterparts in several key respects. Most importantly, public blockchains like Bitcoin and Ethereum (which are the basic collateral for crypto-banking, and power settlement for tokens like stablecoins) are always on, 24/7, with minimal downtime. The blockchains themselves are fundamentally open databases which anyone can read, any anyone can write to, for a fee. This unites transactors within a flat global network of users, without exclusion.

Building on top of these systems is permissionless and generally subject to less regulatory overhead than the standard banking system. Lower barriers to entry mean that crypto can more easily absorb investment capital, giving the industry more “shots on goal,” which allows it to iterate faster. Experiments which work can be scaled up to a global audience. This is simply a superior adaptive model.

While Americans may be spared a reprise of the chaos of 2009, a wave of sovereign defaults is likely in the coming years as emerging market debt unwinds. Currency devaluation and bank crises will surely follow. Thanks to Bitcoin and the industry it catalyzed, individuals the world over now have a potent set of non-state monetary and financial tools at their disposal. They won’t hesitate to use them.

The American Mind presents a range of perspectives. Views are writers’ own and do not necessarily represent those of The Claremont Institute.

The American Mind is a publication of the Claremont Institute, a non-profit 501(c)(3) organization, dedicated to restoring the principles of the American Founding to their rightful, preeminent authority in our national life. Interested in supporting our work? Gifts to the Claremont Institute are tax-deductible.

Playing make-believe with money comes at a very real cost.

A healthy currency must reflect our relationship with nature.

If money is power, the digital world is vulnerable to abuse.