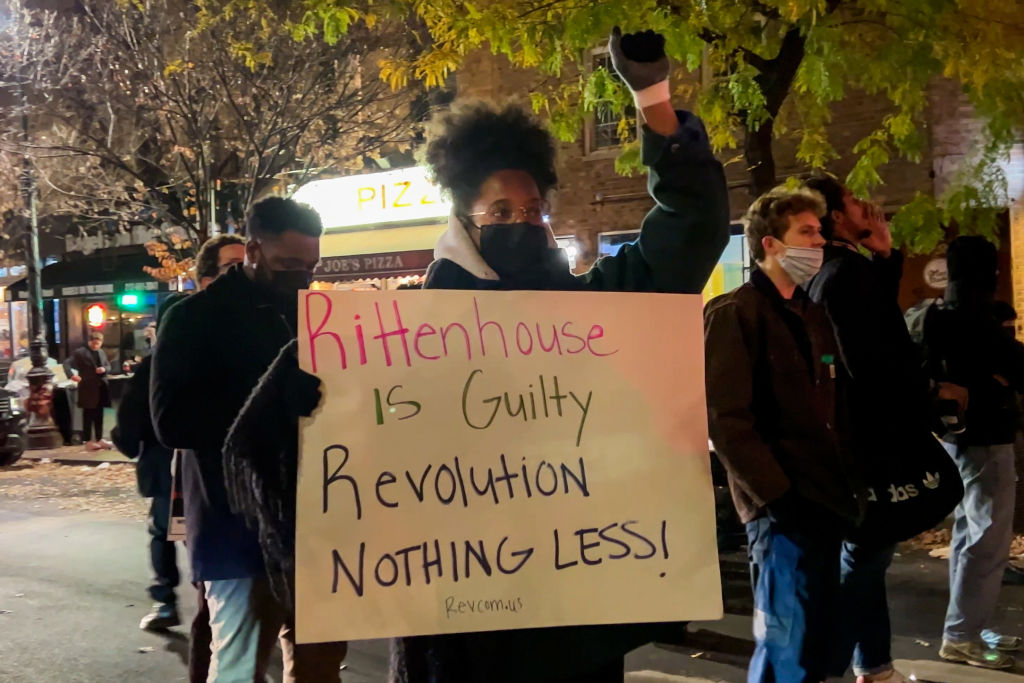

The aftermath of the Rittenhouse trial exposes a bitter divide across the nation.

Woke Credit

We're on the road to a social credit system, whether we like it or not.

Adoption of a Chinese-style social credit score across the West seems more like a matter of “when” rather than “if” at this point. The pandemic has accelerated this tendency, with people in many parts of the United States having become accustomed to presenting their vaccination papers in order to sit down in a restaurant or enter a movie theater. Other countries are further along the curve, with QR-coded cell phone passports required for travel, shopping, work, and public life in general.

But the effort to aggregate personal data into a usable form of social control is taking place on multiple fronts. Credit cards—ubiquitous, trusted, and pre-linked to essential data sources— are an obvious platform upon which to build the new system. We see it happening all around us, but it’s all being rolled out slowly so as not to frighten the prey.

Doconomy is a Swedish tech company that uses its proprietary “Åland Index” to allow consumers to track their individual environmental harm based on various lifestyle factors, including travel and consumption. The company partnered with MasterCard to produce the DO card, which “enables the cardholder to track and measure its carbon footprint for each purchase and to compensate for its impact day by day.” As opposed to standard green-branded credit cards, however, which use a few pennies per purchase to buy carbon offsets, or contribute to enviro-oriented non-profits, the DO Black card tallies the carbon footprint of one’s every purchase and cuts you off when you have hit your limit.

“In other words,” boasts the company, “it’s the first credit card ever to stop you from overspending based on the level of CO2 emissions generated by your consumption.” The card sets a “carbon spending limit” based on Paris Climate Accord targets and issues a “Transaction Denied!” warning when you try to overspend.

Much like the Paris Accord itself, of course, the limit is arbitrary and voluntary, and doubtlessly can be overridden. The type of well-heeled consumers who would carry the DO card—which is composed of biodegradable Poly Lactic Acid instead of plastic—surely aren’t counting on its credit limit to buy their staples; carbon frugality is a luxury only the rich can enjoy. The DO card doesn’t seem to have caught on in a big way yet, but a hard carbon spending limit tied to personal consumption certainly sounds like something that the Regime would be happy to impose. Look for it soon.

Credit card companies track debt and payment levels to generate credit scores, which banks and other lenders use to determine how much to charge consumers to borrow money in the form of interest rates. FICO scores—the industry standard—can also be consulted by employers and landlords to determine, as a kind of shorthand, how reliable their potential workers or tenants are. These scores thus already serve as a kind of social credit index, except they are still largely voluntary. No one has to maintain lines of consumer debt in order to build up one’s score; it just makes it harder to finance large purchases if you don’t.

In our age of racial obsession, the disparate impact of bad FICO scores has attracted the attention of the equity and diversity mob. Blacks and Latinos, it appears, tend to have worse credit, for a variety of reasons, some of which are said to be rooted in racism. In an effort to remedy this problem, advocates aren’t demanding that credit scores be less central to evaluating credit-worthiness; rather, they want an expansion of amount and kind of data that is fed into the algorithms to determine the scores.

The Biden Administration backs the creation of a Public Credit Registry (PCR) under the aegis of the federal Consumer Financial Protection Bureau, to replace the private credit reporting agencies that currently control the market. According to a report from Demos, the leftist policy group with ties to the Democratic Party, “the public credit registry will develop new algorithms for predicting creditworthiness with a goal of minimizing disparate racial impact.” The PCR will include rental history and utility payments, among other data sources, “when these data have been shown to be predictive and to minimize racial disparities.”

Moving consumer credit reporting onto a federal-run platform sounds worrisome even if you aren’t a hard-core conspiracist, so couching it in the language of minimizing racial disparities is a good way to baffle surveillance concerns. But it’s hard to escape the nefarious implications to privacy that the Public Credit Registry represents.

Society is so awash in personal data that it must drive planners and experts crazy that so much of it is going to waste. That’s why we discover from the New York Times that “a study analyzing medical records and consumer credit reports for more than 80,000 Medicare beneficiaries showed that seniors who eventually received a diagnosis of Alzheimer’s disease were significantly more likely to have delinquent credit card payments than those who were demographically similar but never received such diagnoses. They also were more likely to have subprime credit scores.” Who’d have thought that credit scores would be such an important indicator of an unrelated health risk? Let’s start churning through all that data immediately, in the interests of public health, of course.

None of this proves that we are heading toward a Chinese-style system in the next calendar year. But taken together it certainly indicates that we’re going that way sooner or later.

The American Mind presents a range of perspectives. Views are writers’ own and do not necessarily represent those of The Claremont Institute.

The American Mind is a publication of the Claremont Institute, a non-profit 501(c)(3) organization, dedicated to restoring the principles of the American Founding to their rightful, preeminent authority in our national life. Interested in supporting our work? Gifts to the Claremont Institute are tax-deductible.

California’s new graduation requirement has all the hallmarks of CRT.

Remembering the life of a great man.

This year’s title match pits optimist against pessimist.