You don’t know the machine’s agenda.

Let Blockchain Blossom

Don’t let shysters and high-profile frauds spoil the promise of a fantastic breakthrough.

When you hear the word “cryptocurrency,” what images spring to mind? Maybe a pasty American manchild living in the Bahamas, swindling people out of money? Of course, one cannot discuss crypto without discussing Sam Bankman-Fried (or Fraud), the Icarus-like boy-wonder who flew a little too close to the sun and got badly burned in the process. The soi-disant “effective altruist,” once worth an estimated $16 billion, effectively and not so altruistically used billions of his customers’ dollars to prop up Alameda Research, the infamous trading firm he also owned. The 30-year-old, one of the Biden campaign’s most generous donors, finds himself charged with eight different crimes, including wire fraud and money laundering. SBF now faces up to 155 years in prison.

Although he’s by far the most notorious, SBF isn’t the only influential figure guilty of committing crypto-related sins. Logan Paul and his younger brother Jake are YouTubers with a huge social media influence. On Instagram alone, they boast well over 20 million followers each. They both stand accused of participating in numerous crypto scams, knowingly misleading their fans and making millions of dollars in the process. The brothers certainly seem to have profited handsomely from their unethical and borderline criminal endeavors; the same, though, can’t be said for the tens of thousands of investors who believed their hype.

However, to equate crypto with the likes of SBF and the Paul brothers is to lose sight of a much broader picture. To view these men as being an accurate reflection of the crypto sector is like equating alcoholism with Ireland. It’s lazy and wholly unjustified. Has the crypto sector created opportunities for bad actors to profit? Of course it has, but this is true of any sector where large sums of money are swirling around. It’s important to remember that this sector has also created (and continues to create) opportunities for everyday people to separate themselves from the current financial system. Before going any further, let’s first separate the SBFs of the world from the Michael Saylors, separate Bitcoin from shitcoin, and realize that reports around crypto are very often misleading.

Today there are more than 20,000 different cryptocurrencies in circulation. For people entering the crypto sector, the options seem endless. In truth, they’re not. When it comes to investing, there are only two coins worth discussing: Bitcoin and Ethereum. The former, the first ever cryptocurrency created back in 2009, is the largest cryptocurrency by market cap. Contrary to popular belief, Bitcoin is not nearly as bad for the environment as so many would have us believe. Also, contrary to popular belief, as I have shown elsewhere, Bitcoin does serve an everyday purpose, especially for those who live in countries where access to traditional financial institutions is no longer possible or so corrupted as to be undesirable.

Bitcoin’s (and Ethereum’s) underlying technology is called blockchain, the real star of the show. For the uninitiated, a blockchain is a distributed software network that fulfills two key functions. First, it acts as a digital ledger that facilitates the recording of transactions between parties in multiple places in real time. Secondly, by eliminating the need for an intermediary, blockchain technology allows a relatively secure and instantaneous peer-to-peer transfer of assets. The importance of this nascent technology can’t be emphasized enough. As the Blockchain Institute notes, like the internet, “a technology that facilitates the digital flow of information, blockchain is a technology that facilitates the digital exchange of units of value,” including currencies, land titles, and even votes, which all “can be tokenized, stored, and exchanged on a blockchain network.” In the same way that the internet revolutionized communication and is enabling you to read this piece of writing, blockchain possesses the power to revolutionize the ways in which we conduct business.

Though blockchain, a transparent and traceable system, was initially designed to allow the secure transaction of Bitcoin, it has grown to allow the secure transaction of other assets, including Non-Fungible Tokens (NFTs). The common perception of NFTs is of a wild collection of pixelated apes, or maybe the former president Donald Trump in a cape. But these blockchain-based tokens can be used to represent much more than gimmicky artwork. They are unique digital assets that can be used to prove ownership of physical items, including real property, not just items in the virtual world. NFTs are particularly popular when it comes to fractional ownership, in which many individuals own a percentage of a property or properties. To be clear, I’m not trying to pump NFTs. I simply want to show that the technology can enable the exchange of value of real assets, not just the ownership of extortionately priced artwork.

Without blockchain, there wouldn’t be any cryptocurrencies or NFTs. And without blockchain, there wouldn’t be any talk of decentralized finance (DeFi) either. This fast-emerging field of financial technology was designed to give TradFi a run for its money. And why not? Unlike the traditional system, very much centralized in nature, DeFi promotes financial systems that are powered by decentralized blockchain technology. While offering the possibility of democratizing the financial system, DeFi has a long way to go before it will disrupt the world’s central banks. But in an age of increased centralization of data, knowledge, and power, the promise of this new technology to liberate, rather than enslave, humanity is too potent to reject out of hand.

All of this brings us back to SBF and the Paul brothers. Con artistry is as old as mankind. Shameless opportunists have always existed to prey off the naiveties of others. But there is a much broader story here, one driven by blockchain, that is worth remembering. Blockchain is an amoral tool; it can be used to fatten the pockets of fraudsters, but it can also be used to offer law-abiding citizens an alternative to systems that they no longer feel comfortable supporting.

The American Mind presents a range of perspectives. Views are writers’ own and do not necessarily represent those of The Claremont Institute.

The American Mind is a publication of the Claremont Institute, a non-profit 501(c)(3) organization, dedicated to restoring the principles of the American Founding to their rightful, preeminent authority in our national life. Interested in supporting our work? Gifts to the Claremont Institute are tax-deductible.

Elon Musk rules over his social media demesne as a kind of digital statesman.

The world’s largest transportation providers are suffering from a nasty case of COVID whiplash.

Transhumanism is the accelerationist endpoint of liberalism.

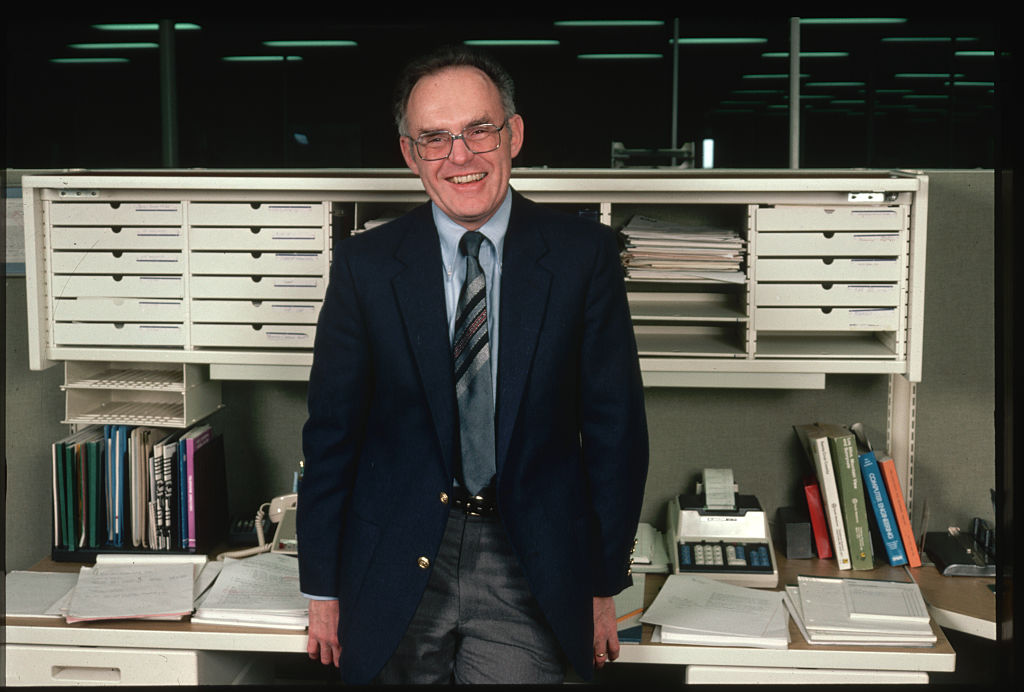

Gordon Moore was the last of the great twentieth century American innovators.

We don’t need to embrace dystopian transhumanist fantasies to optimize our well-being.