A healthy currency must reflect our relationship with nature.

Degrading the Dollar

America’s inflation has more staying power and deeper roots than Washington admits.

After months of describing inflation as a “transitory,” Washington has at last admitted what every American has known for some time: inflation is severe and shows no sign of abating. Administration officials refuse to admit error—not unusual in Washington—but they have at least acknowledged the inflationary reality and have walked back earlier comments. Because inflation has more fundamental roots than Washington has yet admitted, it is comforting that monetary policy has at last begun—though only just begun—to deal with the threat.

Overwhelming evidence has forced the change in Washington’s tune. At the close of 2020, the Federal Reserve (Fed) confidently forecast low inflation for 2021. Using its preferred indicator, the consumer price index deflator (CPI), it announced its expectation of 1.8 percent inflation for this year. Last spring, the Biden administration also forecast low inflation. Its budget put 2021 CPI inflation at 2.1 percent. By October, the CPI was up at a 7.0 percent annual rate for the year so far, more than three times the budget forecast. The consumer price deflator had risen at a 5.1 percent annual rate, more than twice the Fed’s original forecast. It has become impossible to dismiss reality.

So far, administration spokespeople—Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen—have blamed inflation entirely on supply chain problems. Some official rhetoric unsurprisingly includes the usual accusations of price gouging by evil businesspeople, but that is mostly a way of deflecting blame. There is some merit in their contention. Months of lockdown and quarantine in 2020 and 2021 left production facilities and shipping arrangements unable to respond fully to the economy’s rebound from pandemic strictures. But if supply-chain issues have contributed to inflationary pressures, they are more complex and less easily resolved than Washington suggests. Still more disturbing is how the official commentary ignores more fundamental inflationary threats from past monetary and fiscal policies, as well as from changing world trade patterns.

Denial Runs Deep

The stakes are high. If inflation fails to dissipate, as Washington promises it will, rising prices will embed themselves in people’s expectations and in doing so distort everything in the economy, none of it to the good. Inflation can take on a life of its own as wage demands reflect expectations of future cost of living increases, and pay agreements assume that rising prices will compensate for inflated wage hikes. This self-sustaining pattern makes any efforts to ease the pressure that much more difficult. The uncertainties inflation creates about value will make planning impossible. Businesses accordingly will hold back from the long-term investments on which economic growth depends. Investors will flee stocks and bonds in favor of real estate and other assets that they believe will keep up with the rising cost of living. Interest rates will rise, and stock prices fall. Perhaps today’s real estate surge is a sign that this kind of unproductive adjustment has already begun. All will combine to slow the economy’s pace of growth.

Even if, as Washington says, the entire inflation problem is supply chain related, the pressure will last longer than Powell, Yellen, and the White House have suggested. Certainly, the nation’s worker shortage will not disappear overnight. Fears of infection have kept many people away from the workplace and will continue to do so, while government benefits, even after the end of special unemployment payments, will allow others to stay at home. This is no small number. Recent Labor Department statistics show that the workforce is still 5.5 million, or 3.5 percent, below pre-pandemic levels. On top of this effect, vaccine policies, government and private, have further curtailed the nation’s workforce. Little hard data exists on this question, but an extrapolation of anecdotal evidence suggests the loss of one million more workers.

At the same time, the Delta and now Omicron variants have kept production facilities shuttered in China and other major Asian export economies. The loss of these facilities has caused major interruptions in the flow to the United States of consumer goods—clothing, shoes, and toys especially—as well as parts needed for domestic production efforts. Malaysia, for instance, is a major supplier of computer chips for cars.

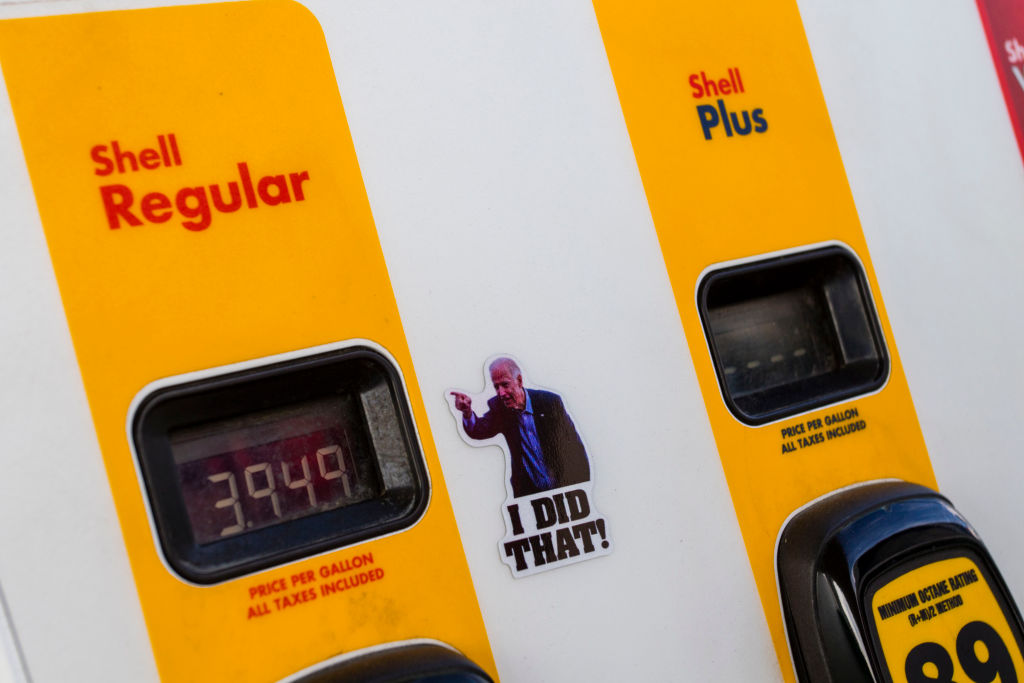

Oil Boil

Perhaps most significant in this mélange of trouble is the energy shortage. The post-pandemic demand surge would have strained production potentials in the best of circumstances, but policy actions have made matters worse. President Biden began his term by shutting down the Keystone Pipeline and doing what he could to curtail fracking. Whatever the justification for his actions, they have contributed to a 14 percent drop in North American fossil fuel production. Green initiatives have exacerbated the problem. Marginal oil and gas production was shut down, as were coal mines. It will take time to restart these operations even if President Biden were to reverse his policies tomorrow. It is harder still to ramp up wind, solar, hydro, or nuclear to meet heightened energy demands.

These are not problems that dissipate quickly, whatever Biden, Powell, and Yellen claim. It looks as though Transportation Secretary Pete Buttigieg’s forecast of full relief by mid-2022 stands on the optimistic side of likelihoods. And once supply chain problems ease, it will take even longer to see a reflection in inflationary pressures. And there is a still more ominous side to the inflation equation. Behind the supply chain issues lie the fundamentally inflationary policies pursued by Washington for years now.

Easy Money

Pretty much consistently since the 2008 financial crisis, our fiscal and monetary policies, under both Democrat and Republican administrations, have been extraordinarily expansive. Unprecedented budget deficits have become common. Easy monetary policies have flooded the economy with new money. These policies have financed aggressive government spending with the electronic equivalent of the printing press. The Fed during this time has purchased over $5.0 trillion in newly issued federal debt, over $3.0 trillion of it in the past year alone. Both history and economic theory identify such behavior as a primary cause of inflation. Even if the president’s huge “Build Back Better” spending program fails to become law, the stage seems set for still more inflation. History shows that the lags from such policies to inflation are often long and always variable, but it is beginning to look—supply chain considerations aside—as though these lags have run their course and the inflation has arrived.

Ongoing adjustments in world trade seem set to add to inflationary pressures. For decades, the U.S. has sourced cheap products from China and other emerging economies. Perhaps it was these cheap sources that elongated the lags from floods of liquidity to an inflationary response. But now wages in China, though still low by the standards of the developed world, are beginning to catch up, while the old supply arrangements are becoming less reliable. Whether this is true of not, it should be clear that a major inflation moderator of the past is weakening. Moreover, decades of low birth rates have slowed the flow of new workers into the labor force just as the huge baby-boom generation is retiring. Today’s immediate labor shortage has other causes, but the demographic effect will surely intensify labor shortages over time, creating an inflationary push of its own.

Because of these additional and more fundamental inflationary considerations, it is welcome that the Fed has at least begun to change policy. It has committed to slowing the pace at which it adds liquidity to financial markets, what the Fed calls “quantitative easing.” Each month it will add a little less than the month before until, by the middle of 2022, the Fed will end the program entirely. Then, if inflation has not yet abated, the Fed plans to raise interest rates and move toward a still more restrictive, anti-inflationary policy posture. It may be too little, too late to head off inflationary pressures, not least because federal government spending continues along an expansionary path, but one takes what one can get.

Given the damage entrenched inflation can do to the economy— and people’s lives—all should wish that Washington is correct, and that the price pressure dissipates relatively soon. But since that outlook is highly unlikely, a more effective path would trade fond hopes for a cold realization at the Fed and in Congress that they need to reverse the policies of the past. The Fed should drain excess liquidity from the economy faster than is presently planned, and the government must reconsider its drive to accelerate the federal spending spree.

The American Mind presents a range of perspectives. Views are writers’ own and do not necessarily represent those of The Claremont Institute.

The American Mind is a publication of the Claremont Institute, a non-profit 501(c)(3) organization, dedicated to restoring the principles of the American Founding to their rightful, preeminent authority in our national life. Interested in supporting our work? Gifts to the Claremont Institute are tax-deductible.

Donor dollars shouldn’t be made in China.

So you won on education? Now reform it.